Option Tools

Optionistics - Stock Options Trading ToolsOptionistics offers a comprehensive set of charts, tools, stock andoptions data, and options calculators which can be used for analyzingthe US Equity and US Equity and Index Option markets.Options ToolsThere are a wealth of analysis tools available including price and volatility history, option calculators, option chains, volatility skew charts, all free of charge.Options ScreenersNumerous screeners forstocks and complex options are available. Screeners are updateddaily.

Jul 31, 2019 To resolve this issue, use the following methods in the order that they are presented. Method 1: Modify the registry. Click Start, click Run, and then type regedit in the Open box, and then click OK.; Locate and then click the following key in the registry: HKEYLOCALMACHINESOFTWAREPoliciesMicrosoftInternet ExplorerRestrictions If a value. Search by stock fundamentals, technical indicators, and option criteria at one time with our options trading strategies software. Your search criteria can be saved and tested against historical options data: Test your strategy against past market conditions with our options strategy software.

Delayed data is free, subscribers get more timelydata.Our comprehensivetutorial covers the basics of options, the uses of options, optionspricing, and complex option products. The tutorial is free.Read articleswritten by traders. Learn about the chances of profiting from a trade, trading cost, alternate strategies, volatility skew and more.OPTIONISTICS RESOURCESClick on the images below to sample some of our popular resources. For a complete list, check out the.Registered users have access to the complete set of Optionistics tools. Subscribers get the latest data.

Visit our for more information.Stock & Option ScreenersMulti-Leg Option CalculatorProbability CalculatorCopyright © Optionistics.com, 2005-2019Optionistics is not a registered investment advisor orbroker-dealer. We do not make recommendations as to particularsecurities or derivative instruments, and do not advocate thepurchase or sale of any security or investment by you or anyother individual. By continuing to use this site, you agree toread and abide by the full.

Options with unusual activity highlight puts and calls for stocks that have a high volume-to-open interest ratio. The volume for the underlying equity gives an indication of the strength of the current market direction, while the open interest for the put or call tells you the number of option contracts that are currently 'open' (not yet liquidated). When there is a high ratio of underlying volume-to-option open interest, this may be an indication that the options are more 'liquid' and that they may be easier to enter or exit a trade.Site Members may also opt-in to receive an End-of-Day Email report of the top Stocks, ETFs, and Index symbols.

The End-of-Day Email digests are sent at 5:30 PM CT, Monday through Friday.You may enter a date at the top of the page to further filter the data. Exclude any options expiring after the entered date.To be included on the page: For U.S. Market, options volume must be greater than 500, options open interest must be greater than 100, and the volume / open interest ratio must be 1.25 or above. For Canadian market,options volume must be greater than 100, options open interest must be greater than 20, and the volume / open interest ratio must be 1.25 or above.Options information is delayed a minimum of 15 minutes, and is updated at least once every 15-minutes through-out the day.ScreenAvailable only with a Premier Membership, you can base an Options Screener off the symbols currently on the page.

This lets you add additional filters to further narrow down the list of candidates.Example:. Click 'Screen' on the page and the Options Screener opens, pulling in the symbols from the Unusual Options Activity page.Note: ALL the symbols from the page are pulled into the screener. To narrow the list down by expiration date, use the 'Days to Expiration' filter in the screener.

Add additional criteria in the Screener, such as 'Moneyness', or 'Implied Volatility'. View the results and if you wish, save the Screener to run again at a later date. Running a Saved Screener at a later date will always start with a new list of results. Your Saved Screener will always start with the most current set of symbols found on the Unusual Options Activity page before applying your custom filters and displaying new results.Data UpdatesFor pages showing Intraday views, we use the current session's data, with new price data appear on the page as indicated by a 'flash'. Stocks: 15 minute delay (Cboe BZX data for U.S.

Equities is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT.The list of symbols included on the page is updated every 10 minutes throughout the trading day.

However, new stocks are not automatically added to or re-ranked on the page until the site performs its 10-minute update. Page SortPages are initially sorted in a specific order (depending on the data presented). You can re-sort the page by clicking on any of the column headings in the table. ViewsMost data tables can be analyzed using 'Views.' A View simply presents the symbols on the page with a different set of columns. Site members can also display the page using Custom Views. (Simply create a free account, log in, then create and save Custom Views to be used on any data table.)Each View has a 'Links' column on the far right to access a symbol's Quote Overview, Chart, Options Quotes (when available), Barchart Opinion, and Technical Analysis page.

Standard Views found throughout the site include:. Main View: Symbol, Name, Last Price, Change, Percent Change, High, Low, Volume, and Time of Last Trade. Technical View: Symbol, Name, Last Price, Today's Opinion, 20-Day Relative Strength, 20-Day Historic Volatility, 20-Day Average Volume, 52-Week High and 52-Week Low. Performance View: Symbol, Name, Last Price, Weighted Alpha, YTD Percent Change, 1-Month, 3-Month and 1-Year Percent Change. Fundamental View: Available only on equity pages, shows Symbol, Name, Weighted Alpha, Market Cap, P/E Ratio.

Earnings Per Share, Beta, Return on Equity, and Price/SalesData Table ExpandUnique to Barchart.com, data tables contain an 'expand' option. Click the '+' icon in the first column (on the left) to 'expand' the table for the selected symbol. Scroll through widgets of the different content available for the symbol. Click on any of the widgets to go to the full page. Horizontal Scroll on Wide TablesEspecially when using a custom view, you may find that the number of columns chosen exceeds the available space to show all the data. In this case, the table must be horizontally scrolled (left to right) to view all of the information. To do this, you can either scroll to the bottom of the table and use the table's scrollbar, or you can scroll the table using your browser's built-in scroll:.

Left-click with your mouse anywhere on the table. Use your keyboard's left and right arrows to scroll the table.

Repeat this anywhere as you move through the table to enable horizontal scrolling.FlipChartsAlso unique to Barchart, FlipCharts allow you to scroll through all the symbols on the table in a chart view. While viewing FlipCharts, you can apply a custom Chart Template, further customizing the way you can analyze the symbols. FlipCharts are a free tool available to Site Members.

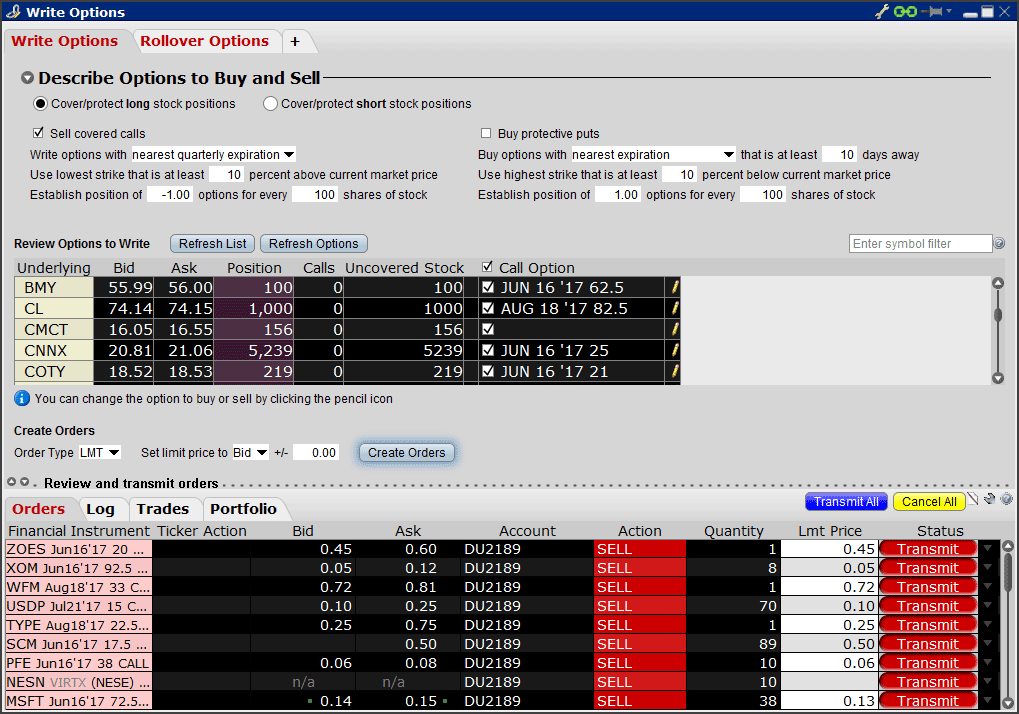

Option Strategy Analysis Tool

DownloadDownload is a free tool available to Site Members. This tool will download a.csv file for the View being displayed. For dynamically-generated tables (such as a Stock or ETF Screener) where you see more than 1000 rows of data, the download will be limited to only the first 1000 records on the table. For other static pages (such as the Russell 3000 Components list) all rows will be downloaded.Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100.csv files per day.Should you require more than 100 downloads per day, please contact Barchart Sales at 866-333-7587 or email solutions@barchart.com for more information or additional options about historical market data.